CEW Promotional Kit

Newsletter

Higher levels of education don’t always result in higher earnings

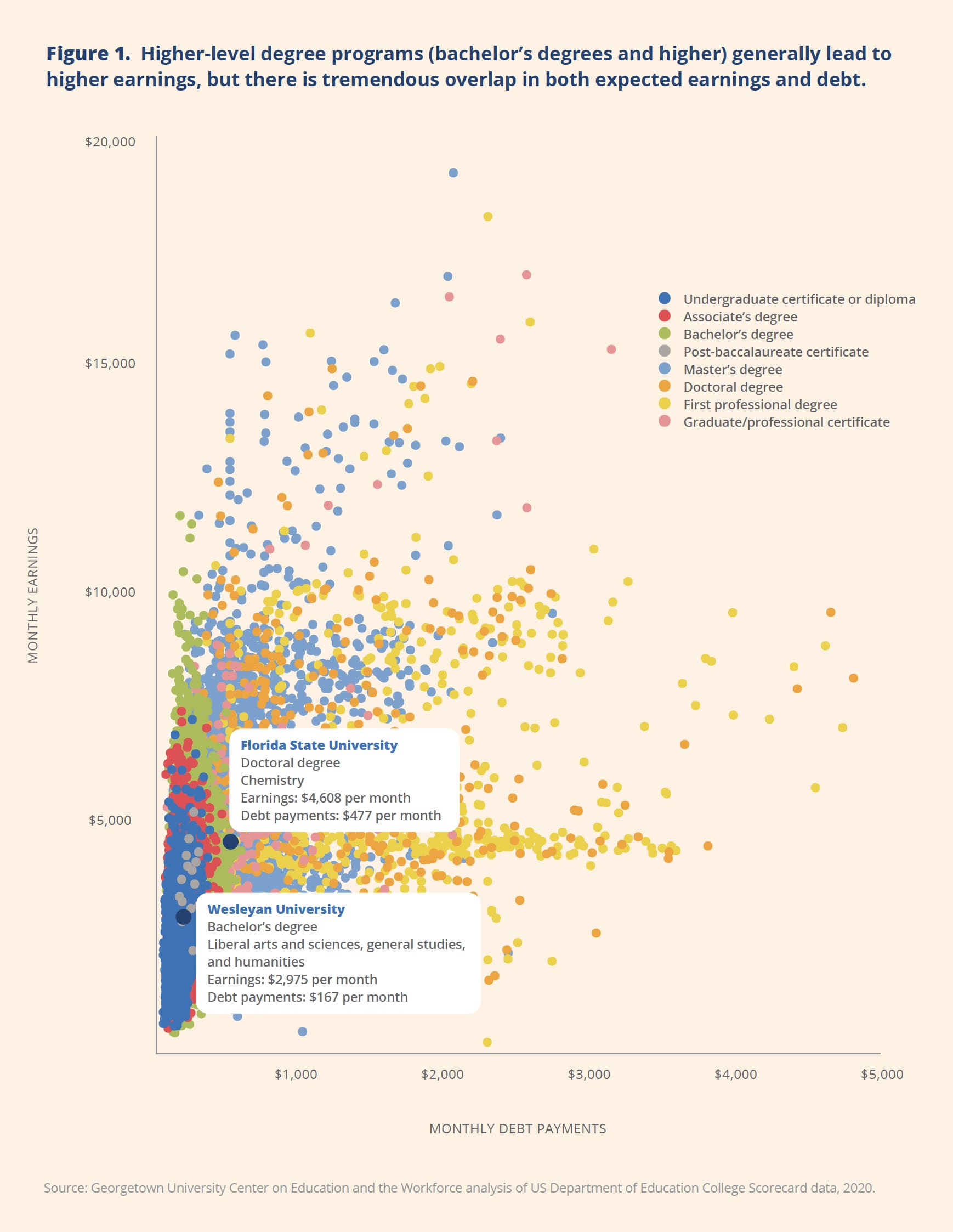

A new report from the Georgetown University Center on Education and the Workforce uses data from the College Scorecard to demonstrate the vastly different outcomes in expected earnings and debt payments for graduates. Buyer Beware: First-Year Earnings and Debt for 37,000 College Majors at 4,400 Institutions finds that first-year earnings for the same degree and major can vary as much as $80,000 at different colleges. The report also finds that higher levels of education do not always result in higher federal student loan debt payments.

1.

A new report from Georgetown CEW finds that higher levels of education don’t always result in higher earnings—or higher student loan payments. Explore the data visualization to learn more about the overlap in earnings and debt within 37K programs and across 4.4K institutions: https://bit.ly/33lOhE5

2.

A new report from the Georgetown University Center on Education and the Workforce shows the vastly different outcomes in expected earnings and debt payments for graduates across programs, degrees, and institutions. 1st-year earnings for the same degree and major can vary as much as $80,000 at different colleges. Check out the report to learn more: https://bit.ly/33lOhE5

3.

“Some of the best bargains for students are community colleges and other colleges without the big brand names,” Georgetown CEW’s Dr. Carnevale said. “This kind of consumer information is just becoming available, and we hope it will help consumers make better decisions.”

Read more from Georgetown CEW’s new report on graduates’ first-year earnings and debt payments: https://bit.ly/33lOhE5

1.

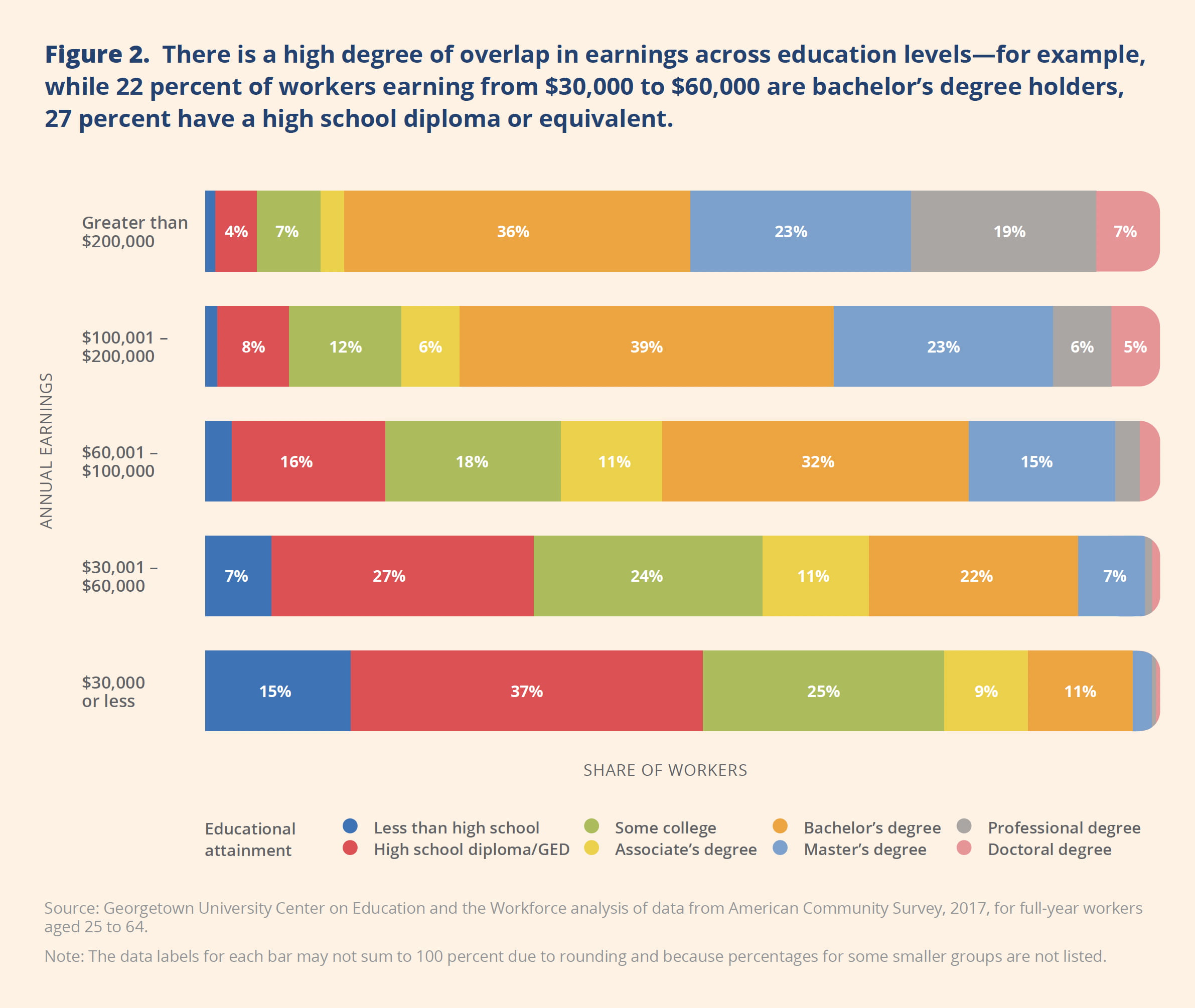

New research from the Georgetown University Center on Education and the Workforce reveals that workers with less #education can often earn the same or more than workers with more education. Here’s what they found:

- 27% of workers with an associate’s degree earn more than the median for workers with a bachelor’s degree

- 35% of workers with a bachelor’s degree earn more than the median for workers with a master’s degree

- 31% of workers with a master’s degree earn more than the median for workers with a doctoral degree, and 22% earn more than the median for workers with a professional degree

Read the new report here: https://bit.ly/33lOhE5

2.

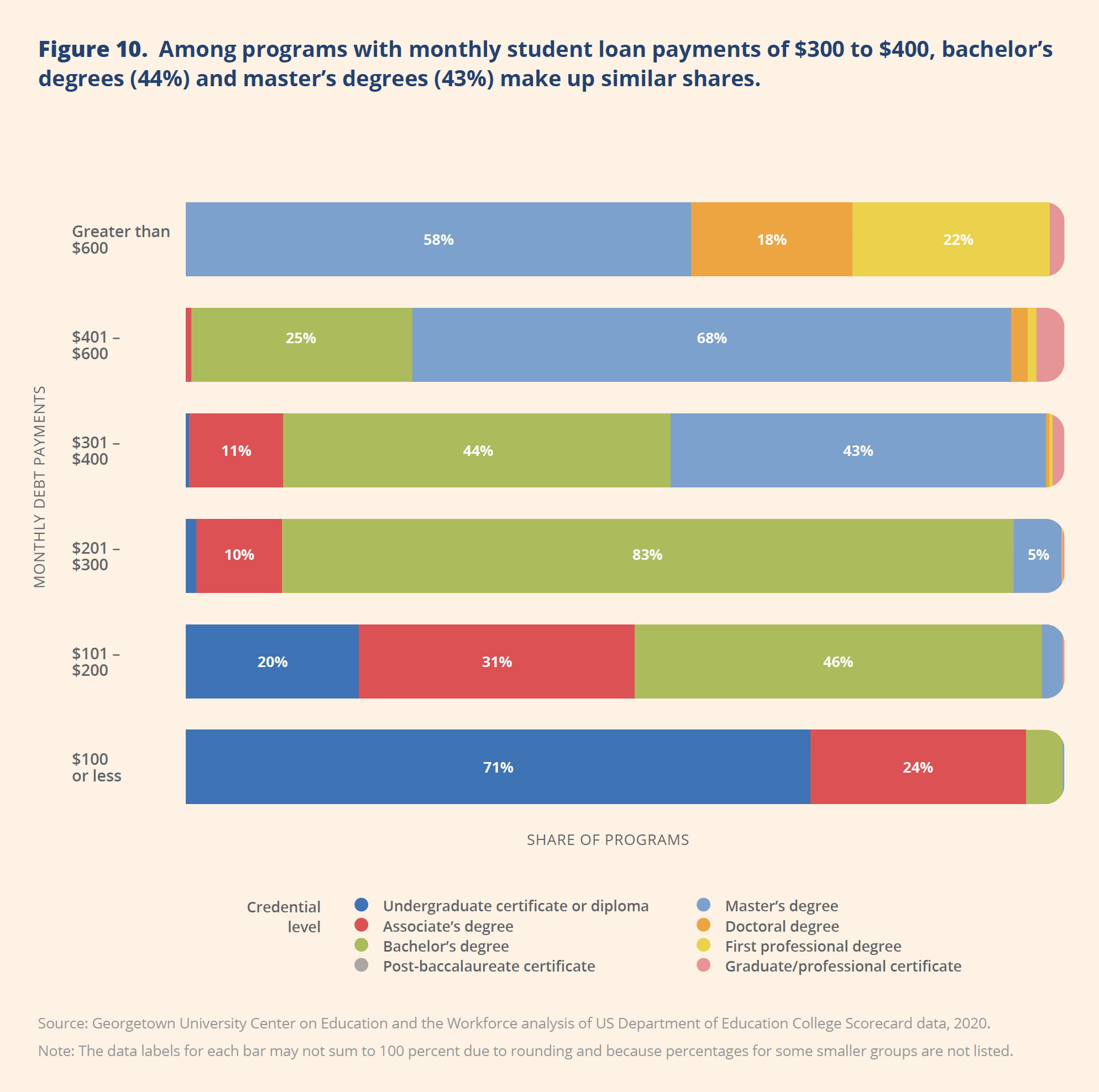

A new report from the Georgetown University Center on Education and the Workforce shows that higher levels of education don’t always result in higher student loan payments. 309 bachelor’s degree programs lead to higher monthly federal student loan payments than the median for master’s degree programs, and 922 associate’s degree programs lead to higher monthly federal student loan payments than the median for bachelor’s degree programs. https://bit.ly/33lOhE5

1.

New @GeorgetownCEW report shows workers with less education can often earn the same or more than workers with more education. While 22% of workers earning from $30K to $60K have a bachelor’s degree, 27% have only a high school diploma. Read more: https://bit.ly/33lOhE5

2.

309 bachelor’s degree programs lead to higher monthly federal student loan payments than the median of monthly federal student loan payments for master’s degree programs. Read @GeorgetownCEW’s new report for more: https://bit.ly/33lOhE5

3.

.@GeorgetownCEW’s latest report explores how some associate’s degrees have higher payoffs in the 1st year after #graduation than some master’s degrees. Read more here: https://bit.ly/33lOhE5

4.

.@GeorgetownCEW’s new research shows that the 10 programs with the highest 1st-year earnings net of debt payments are almost all in #dentistry and #nursing. Read more about the overlap in earnings and debt within programs and across institutions here: https://bit.ly/33lOhE5

Images and Figures

1.

“Some of the best bargains for students are community colleges and other colleges without the big brand names.”

Dr. Anthony P. Carnevale

https://bit.ly/33lOhE5

2.

“Graduates from programs with low first-year earnings and high monthly student loan payments will face the most challenging financial situation after graduation.”

Martin Van Der Werf, Associate Director of Editorial and Postsecondary Policy

https://bit.ly/33lOhE5

3.

Some associate’s degrees have higher payoffs in the first year after graduation than some master’s degrees.

https://bit.ly/33lOhE5

4.

Higher-level degree programs generally lead to higher earnings, but there is tremendous overlap in both expected earnings and debt. Explore the data from the new @GeorgetownCEW report: https://bit.ly/33lOhE5 @GeorgetownCEW

5.

There is a high degree of overlap in earnings across education levels. While 22% of workers earning from $30K to $60K are bachelor’s degree holders, 27% have no more than a high school diploma. Read more from the new @GeorgetownCEW report: https://bit.ly/33lOhE5 @GeorgetownCEW

6.

Debt payments for some programs at a lower degree level may be similar to those for programs at a higher degree level. Explore the data from @GeorgetownCEW’s new report: https://bit.ly/33lOhE5